Best

Options Price Data

Products

Options Price Data includes the prices at which options contracts are bought and sold in the market. It consists of bid prices (the price at which buyers are willing to pay) and ask prices (the price at which sellers are willing to sell). The prices of options are influenced by factors such as the current price of the underlying asset, volatility, time to expiration, and prevailing market conditions. Read more

Our Data Integrations

Request Data Sample for

Options Price Data

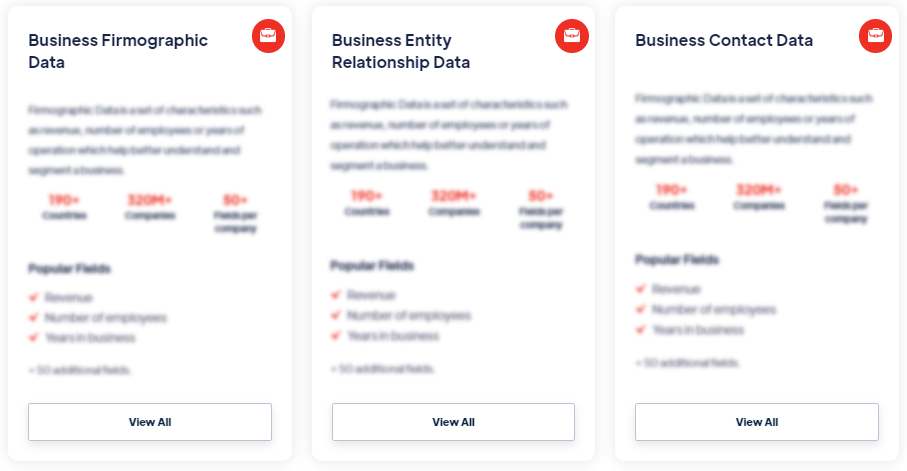

Browse the Data Marketplace

Frequently Asked Questions

1. What is Options Price Data?

Options

Price Data includes the prices at which options contracts are

bought and sold in the market. It consists of bid prices (the

price at which buyers are willing to pay) and ask prices (the

price at which sellers are willing to sell). The prices of

options are influenced by factors such as the current price of

the underlying asset, volatility, time to expiration, and

prevailing market conditions.

2. Why is Options Price Data important?

Options Price Data is crucial for options traders, investors,

and financial institutions. It provides insights into the

market's perception of the value of options contracts and

helps participants assess the potential profitability and risks

associated with different options strategies. Options Price Data

is used to analyze historical price movements, determine fair

values, and make informed trading decisions.

3. What types of data are included in Options Price Data?

Options Price Data typically includes the bid and ask prices of

options contracts, as well as additional details such as the

strike price, expiration date, and contract specifications. It

may also include information about the volume (number of

contracts traded) and open interest (number of outstanding

contracts) at different price levels.

4. How is Options Price Data collected?

Options Price Data is collected from various sources, including

options exchanges, financial data providers, and brokerage

firms. Options exchanges provide real-time price quotes for

options contracts, while financial data providers aggregate and

distribute this data to users. Traders and investors can access

options price data through trading platforms, data vendors, or

APIs.

5. How is Options Price Data analyzed?

Options Price Data is analyzed using various techniques and

tools. Traders and analysts use it to assess the relative value

of options contracts, identify trading opportunities, and

evaluate the potential risk and reward of different options

strategies. Statistical models, options pricing models (such as

Black-Scholes), and charting techniques are commonly employed to

analyze options price data.

6. What are the challenges of Options Price Data analysis?

Analyzing Options Price Data can be challenging due to the

complex nature of options contracts and the presence of multiple

variables that affect their prices. Challenges include data

accuracy and timeliness, handling large volumes of data,

incorporating market volatility and other pricing factors into

analysis, and managing real-time price updates.

7. How is Options Price Data used?

Options

Price Data is used by traders and investors to make trading

decisions, develop options strategies, manage risk, and monitor

market trends. It is employed in options pricing models,

backtesting trading strategies, and conducting quantitative

research. Options Price Data also helps market participants

understand the supply and demand dynamics of options contracts

and their impact on pricing.